The conventional 1% down mortgage is the best financing option in the market to help homebuyers purchase a home with a low down payment. This mortgage program is available to ALL homebuyers and you do not have to be a first time buyer to qualify. Buyers also have the option of removing the mortgage insurance “PMI” from their payment so they can obtain an even lower monthly payment. I included a Question & Answer section below so you know how to qualify for this program.

The 1% Down Conventional Mortgage Program

The conventional 1% down mortgage is very popular with homebuyers, as it is helping them purchase a home with a low down payment and a low fixed rate.

With rising health-care costs and student loan debts that many people have these days, it is getting more and more difficult for homebuyers to save up for a down payment to purchase a home.

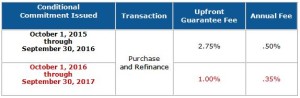

Until recently, buyers had to put down 3% to qualify for conventional financing, or they were stuck with 3.5% down FHA financing and their expensive monthly mortgage insurance if they only had a minimum down payment.

This 1% down mortgage program is helping more buyers obtain homeownership sooner.

To qualify for this new program, a buyer only has to come up with 1% down. Then the lender gives the buyer a 2% lender credit towards the down payment giving the buyer 3% equity at closing.

Please note, there is NO 2nd mortgage or outside down payment assistance programs involved with this 1% down mortgage program. This is a regular conventional financing program.

Buyers can also get a gift for the 1% down payment, so now prospective buyers can reach out to family and ask for a gift to help them purchase a home.

There is also an option to eliminate the monthly mortgage insurance “PMI” from the mortgage payment, so this is helping buyers obtain an even lower monthly payment. This is a great option for buyers, so now they don’t have to worry about having to remove the monthly PMI from their mortgage payment.

With FHA financing, if you put down less than 10% with FHA, you have to pay the monthly mortgage insurance for the life of the loan,

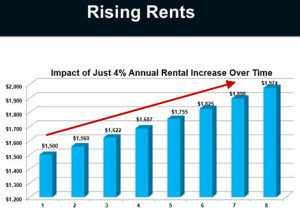

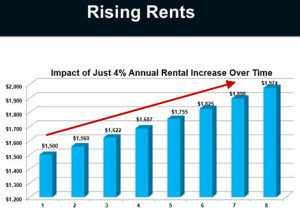

With Rising Rents, Owning a Home is a Better Investment

With monthly rents continuing to rise in most parts of California, home ownership is looking like a much better investment for renters.

As you can see below, just a 4% increase in annual rent, can drive a $1,500 monthly rent up to $1,974 in just 8 years, an increase of $474, which is a 32% increase in overall rent.

Compare this to buying a home and obtaining a low fixed rate and monthly payment that will never change. When you own a home, it is a great hedge against inflation for the future, whereas rent will continue to go up over time.

With the new 1% down program, you can now get into a home for the price of a couple of month’s rent. With mortgage rates also still near all time lows, the cost of borrowing money to finance a home is still very good.

Frequently Asked Questions for the Conventional 1% down mortgage

Here are the most frequently asked questions that buyers and real estate agents have in regards to the new conventional 1% down loan option.

1. What is the maximum loan amount with 1% down?

The maximum loan with 1% down is $424,100, which is the conventional loan limit.

If you need to borrow over $424,100, the minimum down payment is only 5% down.

2. Can I receive the 1% down payment as a gift?

Yes, the 1% down payment can be gifted on this program. Closing costs and reserves can also be gifted if needed.

3. What credit score is required to qualify for this program?

We require a 700 credit score to qualify for this loan program.

4. Is the 1% down program for 1st time buyers only?

No, you just cannot own another home at the time of closing.

5. Is private mortgage insurance “PMI” required with the 1% down mortgage program?

Yes, borrowers are required to pay private mortgage insurance “PMI” on the 1% down mortgage. The amount of monthly mortgage insurance you pay will depend on your credit score. There is also an option to eliminate the monthly PMI from the mortgage payment.

6. How do you eliminate the monthly mortgage insurance “PMI’ option on this program?

It’s very simple. All you have to do is take a slightly higher interest rate than normal, say from 3.75% to 4%, and we use a lender credit with the higher interest rate to eliminate the PMI from the mortgage payment. This is also known as lender paid mortgage insurance.

7. Can I get 1% down on 2nd homes or Investment Properties?

No, the 1% down is for Primary Residences only. On 2nd homes, you only have to put down 10% to obtain the No PMI payment option. On investment properties this program is not available, as you have to put down 20%, which eliminates the Mortgage insurance anyway.

8. Do condos qualify for this program?

Yes, you can also purchase a condo using this program with only 1% down and get the No PMI option.

9. Can I use an adjustable-rate mortgage with the 1% down mortgage?

No, the 1% down mortgage requires a 30-year fixed rate mortgage only.

10. What is the maximum number of units for a home with the 1% down payment mortgage?

The 3 percent down mortgage is for single-unit homes only. This includes single-family detached homes and single-family attached homes such as condominiums and town homes. 2-unit homes, 3-unit homes, and 4-unit homes cannot be financed with the conventional 3% down mortgage.

11. But FHA mortgage rates are lower than this program?

Yes FHA interest rates are lower, but when you factor in the very expensive FHA monthly mortgage insurance, the FHA overall monthly payment will always be higher than this 1% down No PMI option.

12. What if I put down 3% or 5%, will I get a lower rate?

Yes, if you put down 3% or 5% for the down payment, you will get a lower interest rate. With Conventional Financing, The larger the down payment, the lower the interest rate you will get.

There are some other great benefits to using this conventional program vs FHA financing, so you have have more available homes to choose from.

If you would like to get approved for this program, or you have any questions about any of this information above, please feel free to contact me directly at 661-726-9000.